Intro to Online Grocery Shopping Statistics

Just how fast is online grocery growing? What impact has COVID-19 had? What stores and shopping experiences do customers prefer? We set out to answer all of these and more in this article.

Most think of the landscape as online grocery vs. traditional grocery but more accurately its online grocery AND traditional grocery. While online Grocery is emerging quickly, traditional grocery stores are here to stay. So the question is: how will these two channels co-evolve over time? Interesting behavioral insights from recent research are starting to come in. We dove into over 20 sources to bring you the key highlights.

This article, which we intend to regularly update, covers various statistics and insights into grocery store shopping, with a focus on the online e-commerce grocery market.

Questions this article with cover:

- What is the size of the online grocery market in the U.S.?

- How has Covid-19 affected the online grocery industry so far?

- What is the market growth rate of online grocery stores?

- How large is the US e-commerce grocery market expected to become in the future?

- What percentage of people in the US are buying groceries online?

- What online grocery options do consumers prefer and why?

Since here at Superfood Digital we help food and beverage brands increase their online grocery (as well as traditional retail) sales through digital marketing, we are always keeping up with the evolving landscape.

This is a meta-analysis, meaning it pulls from many different reports and sources. We triangulate the various sources to provide an informed estimate of the main online grocery market statistics. Links to the original reports and sources are listed at the end of the article.

Note: Each source is slightly different in how they define terms, the audience surveyed, or what years are covered. Due to simplicity, we show metrics side by side but make note if a major difference in the underlying data source. Check the original sources to learn more specifics about each report’s methodology.

COVID-19 Impact

As of writing this, Covid-19 is taking storm. This event will change the course of history and certainly the course of online grocery shopping. In fact, it already has.

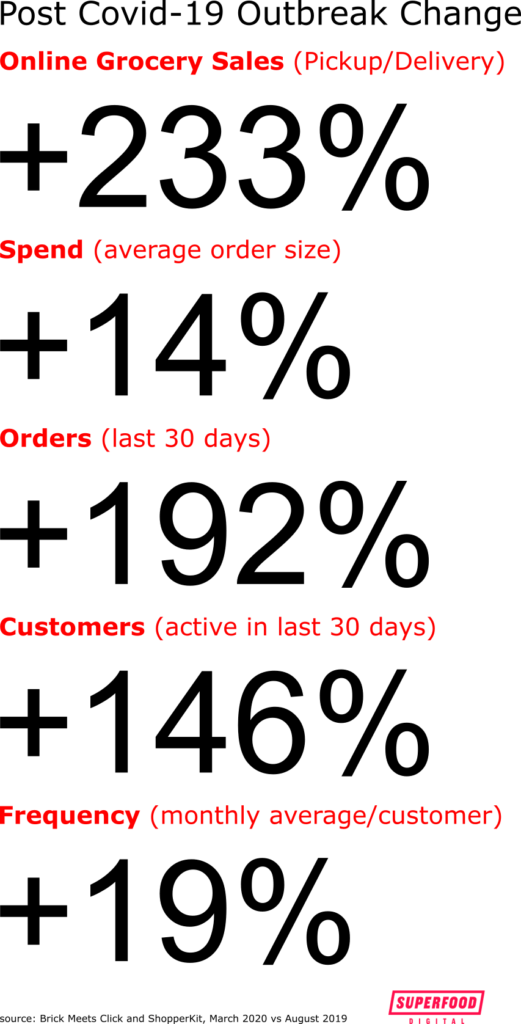

According to Brick Meets Click and ShopperKit, the impact of Covid-19 on the Online Grocery Shopping industry thus far is vast:

The above stats reflect the home delivery and pickup grocery, not ship-to-home, such as Amazon shipments.

That said, most of the statistics in this article are pre-Covid and should generally be considered a snapshot of the 2019 market. As data comes in, we will update. The above increases could be used as multipliers of several of the below circa 2019 numbers for rough estimates until better data surfaces.

With Covid-19 making people less willing to physically visit grocery stores, demand for online grocery shopping (whether grocery delivery, Amazon, store pick-up) is up. Wait time for delivery can now be weeks instead of hours or days. This is set to only accelerate the market sizes and growth rates of online grocery shopping as many are trying it for the first time while others are increasing their frequency.

When/if things get back to semi-normal, it will be interesting to see how many of the new online grocery orders stay online versus reverting to traditional.

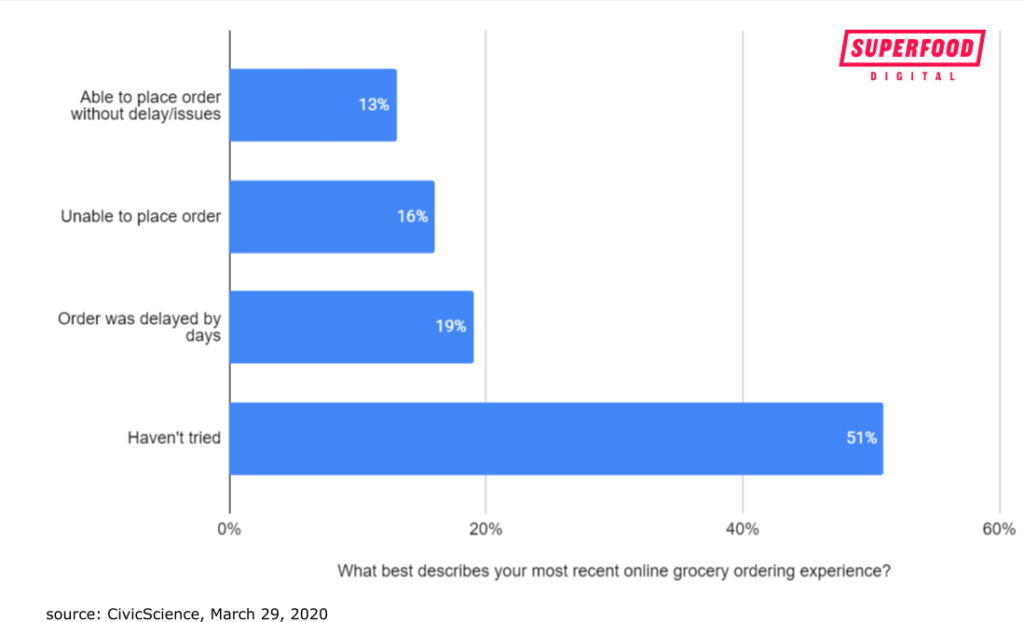

According to CivicScience data, shoppers, many who are trying online for the first time due to coronavirus, are not having a good experience due to delays and other issues:

New online grocery shoppers are experiences frustrations amid Covid-19

Online Grocery Shopping Segments

Let’s now take a step back and clarify what exactly online grocery shopping is.

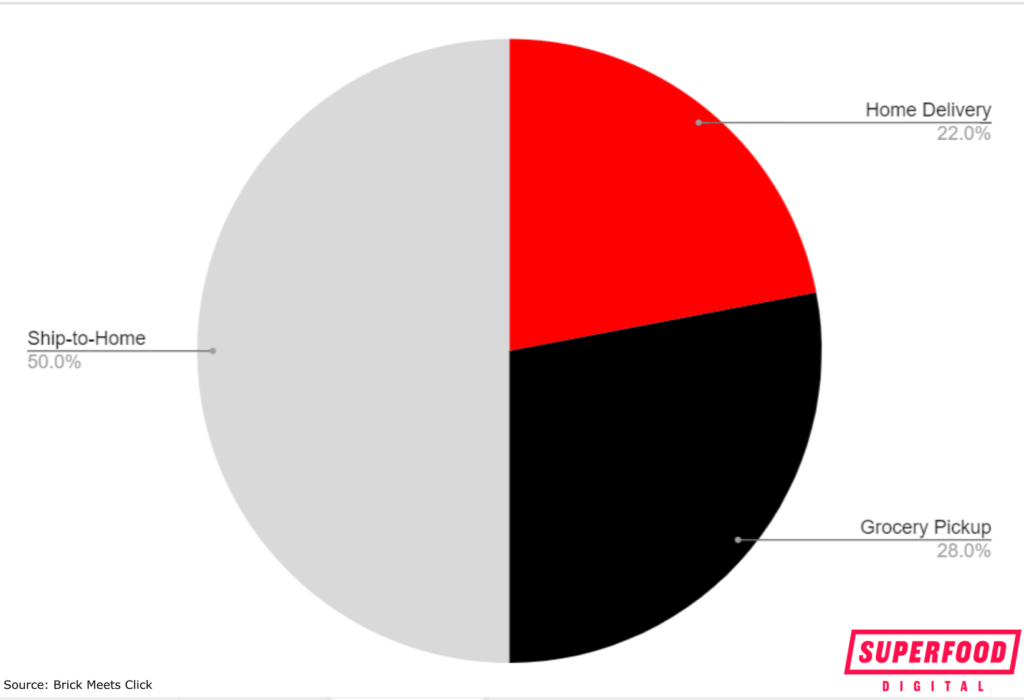

There is not just one way to shop for groceries online. A helpful way to think about is splitting the market into three segments: home delivery, store pickup, and ship-to-home. These purchases all begin online. Brick meets click breaks down the share between each as a percentage of the total:

- Home delivery (22%) (examples: FreshDirect, Instacart)

- Grocery pickup (28%) (examples: Walmart, Kroger)

- Ship-to-home (50%) (examples: Amazon, Thrive Market)

Some of the above companies offer multiple offerings

Percentage of online grocery shopping by market segment

Market Size of Online Grocery (2018/2019)

Now, the number that everyone wants to know: the size of the US Grocery e-commerce market.

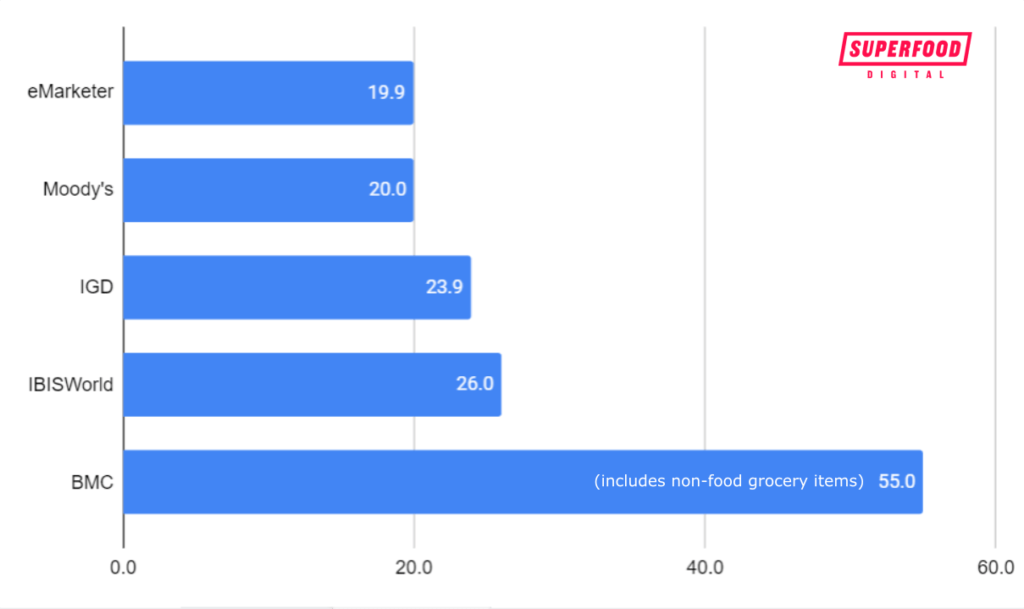

Market size estimates of the US online grocery mostly hover around $20 – $26 billion annually pre-Covid.

- eMarketer estimates the 2019 US food and beverage e-commerce market at $19.89 billion.

- A 2018 Moody’s report calculated the U.S. online food retail business at roughly $20 Billion.

- Institute of Grocery Distribution says online grocery sales in 2018 were approximately $23.9 billion.

- IBISWorld puts the number slightly higher at $26 billion, as of 2018

- Brick Meets Click estimates the online grocery market is $55 billion, as of 2020* which includes non-food items bought in grocery stores like health and beauty care

*Brick Meets Click Grocery definition includes both food and non-food grocery items including household supplies, tobacco, cleaning supplies, personal care products, alcohol for home consumption, pet food and supplies.

Size of US Online Grocery Shopping Market (5 takes)

Online vs retail store market

For comparison, let’s look at how this measures up to the total grocery market including traditional grocery stores, supermarkets, and superstores such as Safeway, Stop and Shop, and Aldi.

What is the size of the overall grocery market including other traditional bricks and mortar retailers like supermarkets?

The size of the total grocery store market is approximately $835 billion (taking an average of the three data points below)

- According to IBISWorld, the size of the overall grocery market was $632 billion in 2018

- According to a 2018 Moody’s report, the overall grocery market is approximately $1 trillion (making online about 2% of the total market)

- $875 billion total grocery (BMC DB)

Growth Rate of Online Grocery

How fast is the US online grocery market growing? In a word, fast.

Looking at different sources, the estimated growth rate of US online grocery ranges from 15% to 24% annually.

- Online grocery grew by 15% in 2019 versus overall grocery growth of 1.3% (BMC)

- eMarketer estimates the US food and beverage market will grow 18.2%

- IGD sees a compound annual growth rate (CAGR) of 20.0% in the US online grocery market over the next five years

- Online retail channels grew by 23.9% from 2017 to 2018 (Mintel/Nosh)

A Bain/Google survey believes e-commerce penetration will at least triple in the next 10 years.

Greater accessibility to online grocery options across the US is driving this growth

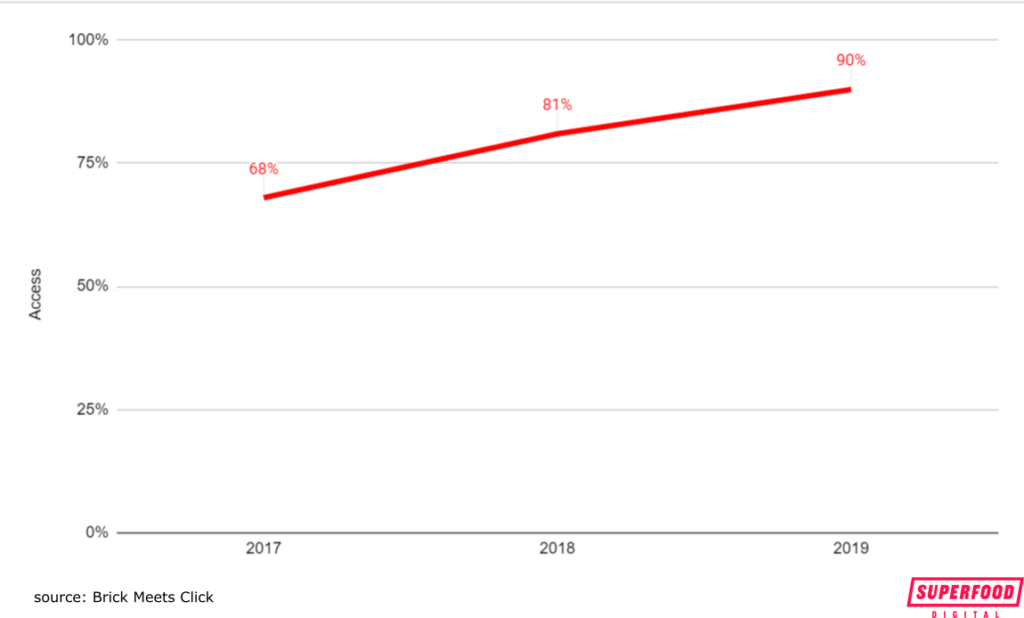

Accessibility to online grocery options has exploded. In 2017, 68% of households had access to either online delivery or store pick up closeby. This jumped to 2018 81% and 2019 90%

Forecast of E-commerce Grocery Shopping

What is the estimated US Grocery market size down the road?

Looking 1 to 3 years from now, estimated market sizes range from $38 to $117 billion.

- By 2021, eMarketer estimates the market to grow to $38.16 billion.

- IGD projects the US online grocery market to reach $59.5 billion by 2023

- Business Insider Intelligence estimates the market will increase to $117 billion by 2023

“By 2025, well over 60% of U.S. will be buying online, including fresh”

-Pradeep Elankumaran, chief executive of Farmstead (source: Marketwatch)

Online share of the total grocery market

While online grocery is growing fast, it’s still a relatively small piece of the overall pie.

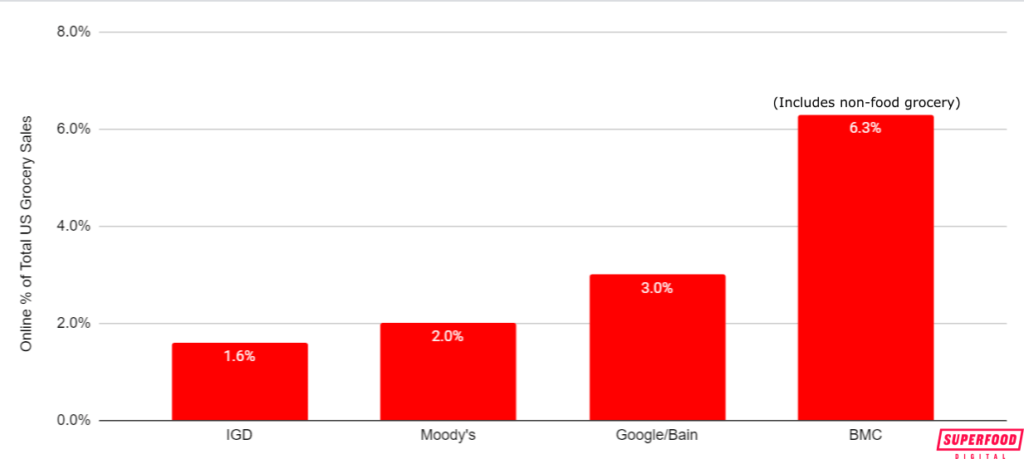

Estimates of online’s share of total grocery food range from 1.6% to 3%.

What is the market share percentage of online grocery within the total grocery market?

- IGD estimates online market share is currently 1.6% (to grow to 3.5% by 2023)

- 3% of groceries are bought online in the US according to research by Bain and Google

- According to a 2018 Moody’s report, the overall grocery market is approximately $1 trillion, or about 2% of the total market

- 6.3% of grocery shopping occurs online (including non-food items typically found in grocery stores) according to Brick Meets Click

Online Grocery vs overall e-commerce penetration

“The online grocery industry is lagging behind US retail as a whole since e-commerce made up nearly 10% of all retail sales in the US in Q3 2018.”

(source: Business Insider referencing Census.gov and Bain/Google)

Loyalty and Repeat Purchases

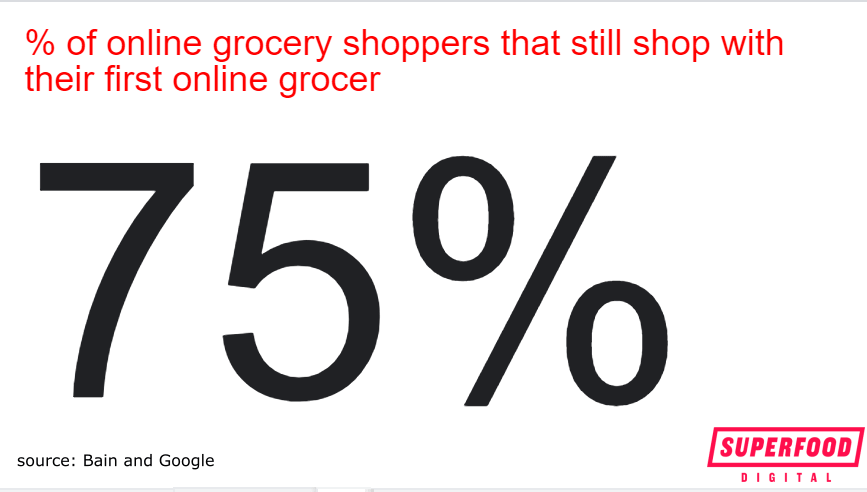

Different sources are reporting different levels of loyalty and repurchases. It will interesting to see if this trend continues over the coming years. If weak loyalty and repeat purchases persist, it is a clear sign of poor customer experience or just the pros not outweighing the cons compared to visiting a traditional supermarket. Some statistics are encouraging like the following which notes that 75% of online grocery shoppers have stuck with their first online store:

Others have found that online grocery shoppers just use initial incentives for the discounts and then just go back to their traditional grocery store ways:

“The No. 1 reason many customers got groceries delivered was that they received an incentive to do so. But when those promotions go away, so do the customers.”

(source: The Atlantic)

Brick Meets Click has also found that frequency has not risen significantly. Purchase frequency was flat in the last year (pre-Covid). While shoppers start at a low frequency and ramp up with familiarity, there was no measurable increase in order frequency. This is an indication that most people don’t want to use e-commerce as their primary shopping channel for grocery.

Frequency of online grocery orders

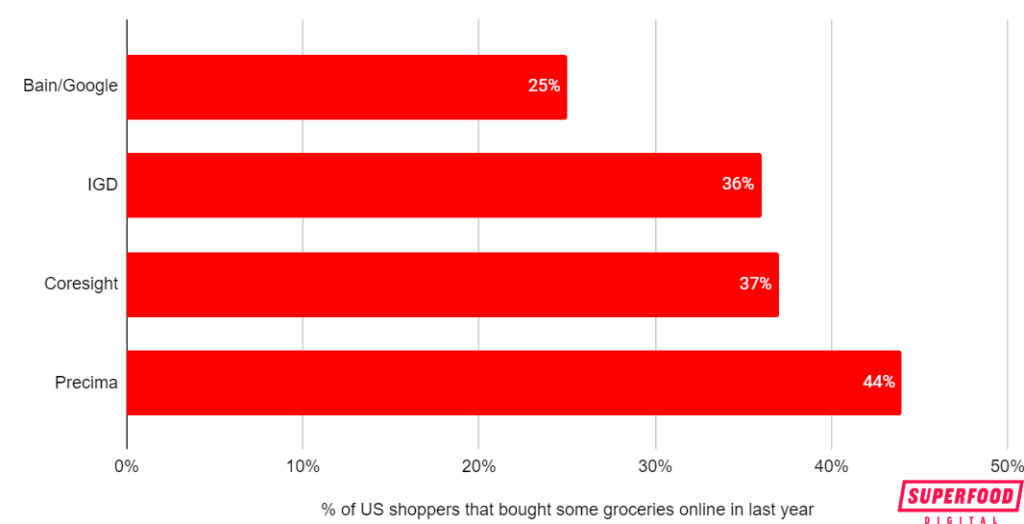

While the total online grocery share is low single digits, what percentage of Americans buy groceries at least some of the time or regularly?

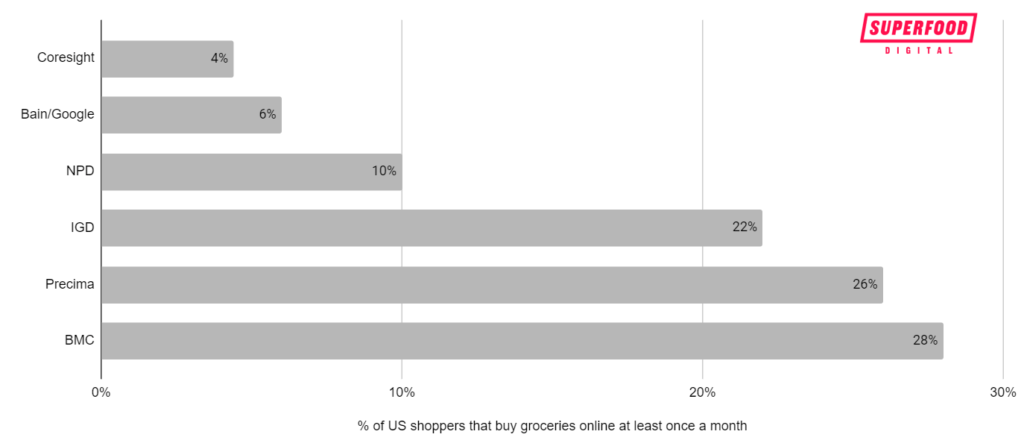

The estimated percentages of Americans that shop online for groceries vary widely from mid-single digits to more than 25%.

Shoppers that purchase groceries online regularly (at least once a month or so)

- NPD Group estimates 10% of US consumers regularly buy groceries online

- Bain/Google believes 6% of Americans use an online grocery service at least once a month

- Coresight found 4.4% buy ‘a lot’ of their groceries online

- IGD reports 22% of US consumers shop online for groceries at least once a week, double the previous year

- 28% of US households have purchased groceries online of any order size in the last 30 days (up 5% over last 12 months) according to a 2020 Brick Meets Click report

- 26% of shoppers buy groceries online monthly according to Precima

- Bain/Google found about 25% of grocery shoppers used an online grocery service in the last year

- Coresight estimates that 37% of US consumers purchased groceries online in the past year (up from 23.1% in 2018)

- IGD believes that approximately 36% of US consumers bought groceries online in 2018, up 11 percentage points from the previous year

- 44% of shoppers buy online (of these 59% buy at least once a month) according to Precima

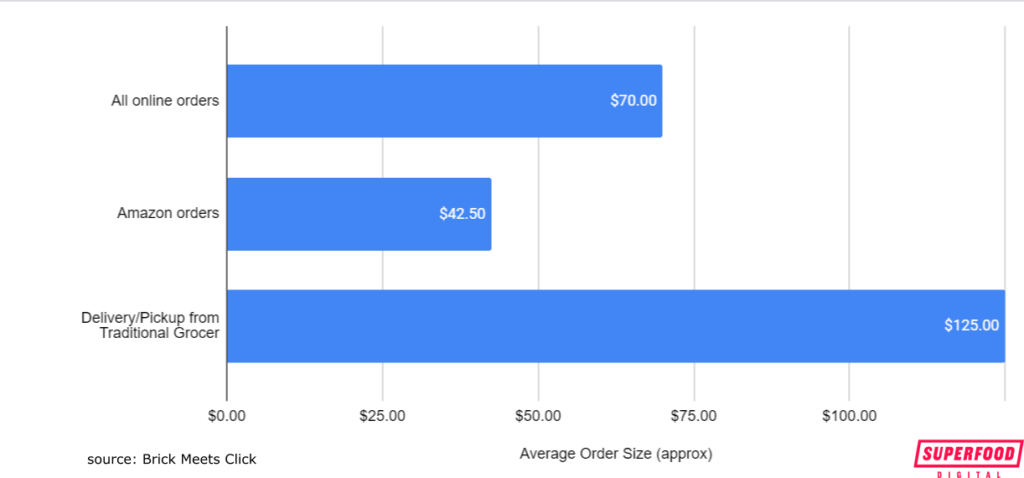

Average Order Size of E-commerce Grocery

The average online order across ship-to-home, delivery, and pickup hit $70 this year, up 6% according to Brick Meets Click.

However, the size of Amazon orders are much smaller than traditional stores that now have online options such as Target, Kroger, and Walmart says research from Coresight. BMC found the average Amazon order is usually only around $40 to $45. Yet for home delivery and pickup, services connected more with traditional grocery stores, the average order is over $100 and often $150.

Top Retailers in Online Grocery

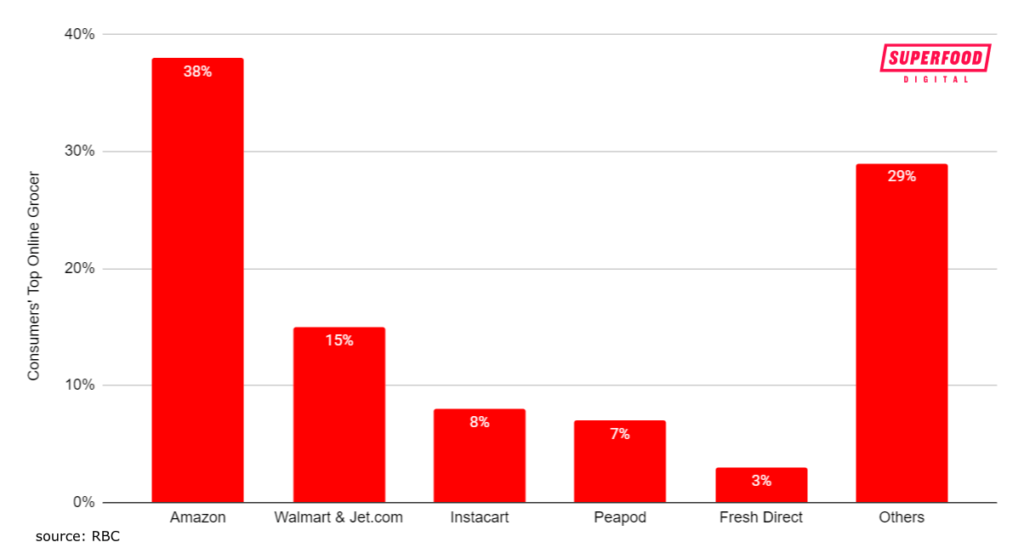

What is the most used online grocery platform in the US?

While Amazon is the most popular, it certainly is feeling the heat from strong competitors who are using their local physical stores, brand names, and loyal customers to its advantage.

- Amazon is the top online grocery choice but is apparently losing ground according to Business Insider citing RBC (other sources below disagree FYI). In 2018, 38% of online shoppers named Amazon as their #1 online grocer, almost half of the previous year.

- Over the same period, Walmart and Jet.com’s share tripled from 5% to 15%.

- Online grocery services took market share also. Instacart rose from 3% to 8% and Peapod’s from 4% to 7%. Fresh Direct held steady at 3%.

- 29% of online shoppers prefer grocers in the “others” category which includes some major and regional players such as HEB, Target, Albertsons, and Aldi.

Some other surveys came to similar conclusions including this one from Coresight showing Amazon as number 1 but Walmart and others catching up quickly:

- 62.5% of all online grocery consumers in the US in the past year bought from Amazon, securing its position as the top online grocery option.

- 37% have bought groceries online from Walmart, 16% from Target, both up significantly from previous years.

- While Amazon online grocery shoppers increased 3% last year, Walmart’s increased by nearly 12% and Target’s 9%

Prime vs. non-Prime Members

- As expected, a large number of Prime members (68.2%) have shopped Amazon for groceries in the last year according to Coresight

- However, Walmart is beating Amazon with non-Prime members. 45.1% of non-Prime digital grocery shoppers have bought groceries online from Walmart in the last year as opposed to only 44.1% from Amazon.

Retail Feedback Group found that Walmart actually overtook Amazon in 2018:

- 33% of US digital grocery shoppers purchased online groceries from Walmart in 2018 (up 7%) compared to 31% who purchased online groceries from Amazon in 2018 (up 5%)

Emarketer found similar market share for Amazon grocery:

- Amazon had 32.7% market share of US food and beverage e-commerce sales in 2019

“Walmart, Target and Kroger are all leveraging their sizeable brick-and-mortar footprints and click-and-collect capabilities to aggressively ramp up their sales and challenge Amazon.”

(source: eMarketer)

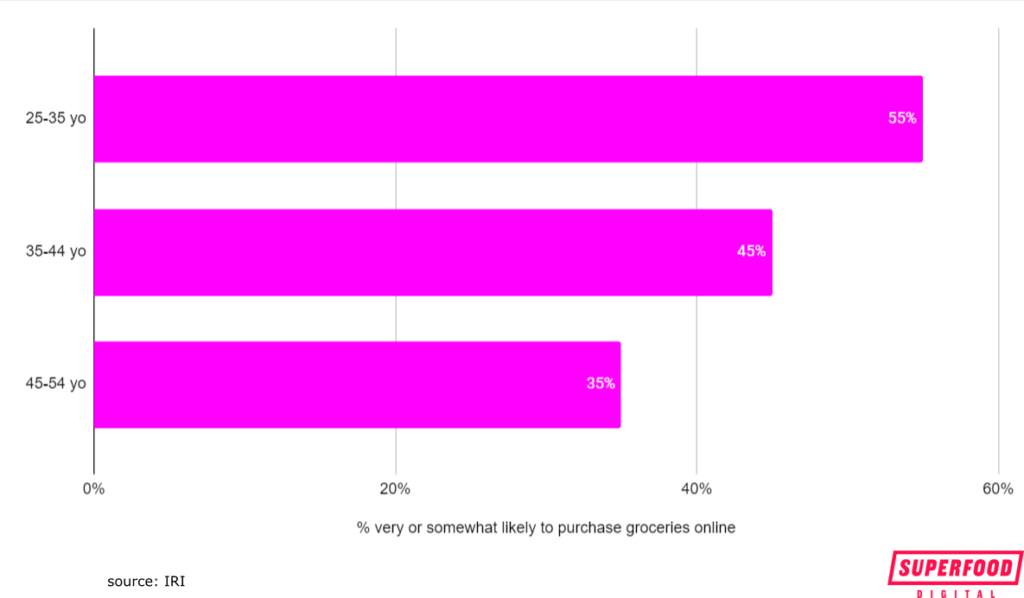

Demographics of Online Grocery Shoppers

What age groups are most likely to shop online grocery? Not surprisingly, the younger demographics, namely 25 to 34-year-olds are spearheading the market growth:

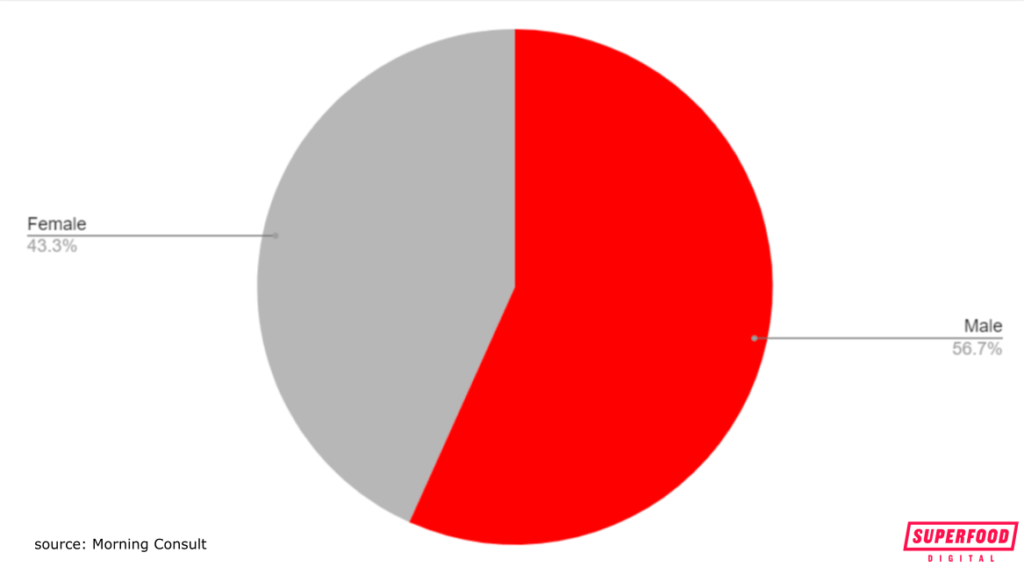

In terms of gender, men are more willing to purchase groceries than women, according to a survey by Morning Consult

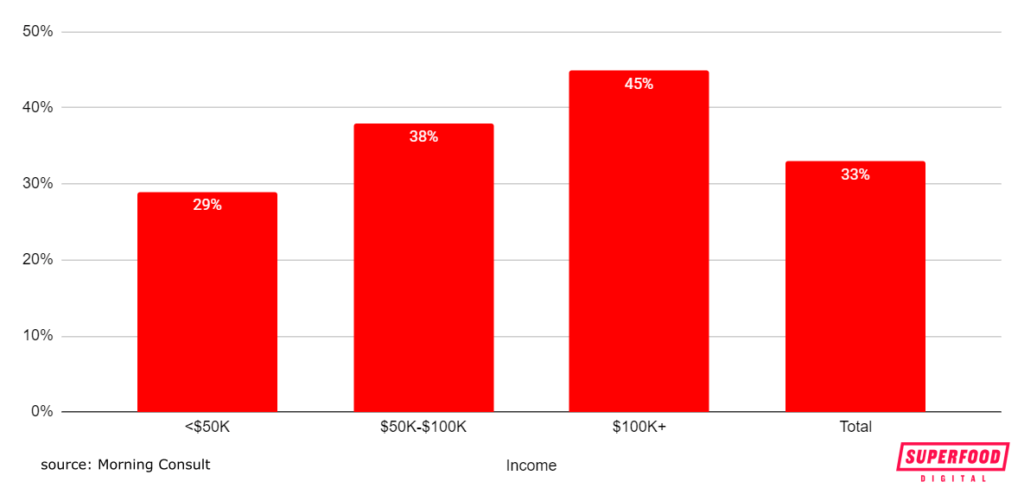

With regards to income, the more affluent seem to be the most likely to use online grocery options:

“Online grocery buyers currently skew toward young, affluent and urban households that are pressed for time and value convenience. They are more likely to be heavy e-commerce buyers across other categories and early adopters of new technology.”

(source: emarketer)

Customer Buying Factors for Online Grocery

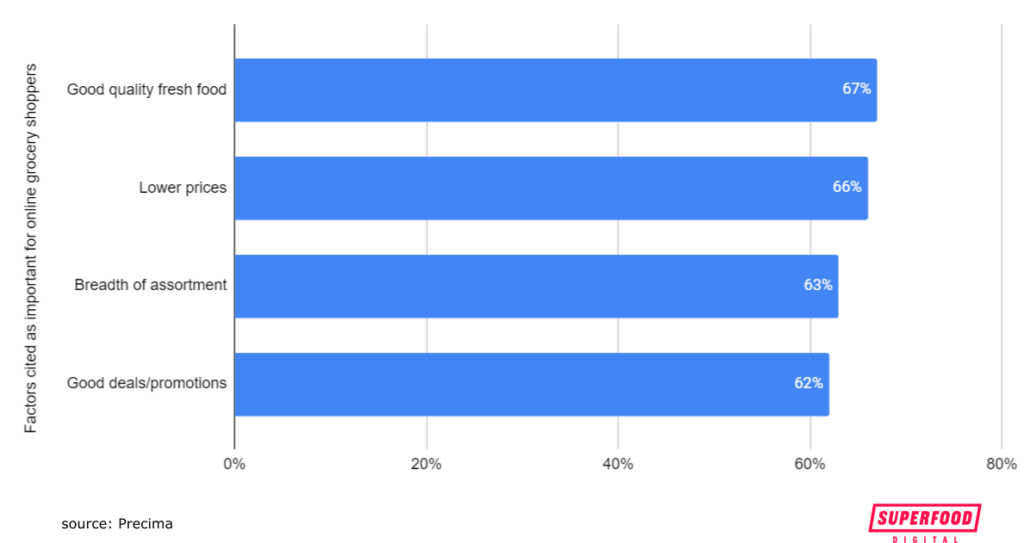

Online grocery shoppers view the most important buying factors to be customer service (68%), quality of delivered fresh food (67%), convenient delivery windows (66%), and low prices (66%), according to Precima.

Takeaways – US Online Grocery Industry

- The size of the US online grocery market in 2019 was approximately $20 – $26 billion but has seen explosive growth in 2020 after the Covid-19 outbreak

- Covid has more than doubled active online customers, orders placed, and sales

- The growth of the market before coronavirus was approximately 20% per year, due largely to more parts of the country receiving accessible online grocery options for the first time

- Most research expects the US online grocery market to at least triple by 2023

- Prior to Coronavirus, online accounted for only 2-3% of the US total grocery sales, much less than the e-commerce share in other industries

- While Amazon is the most used online grocer, Walmart and other traditional retailers are catching up quickly by leveraging their brand awareness and physical locations

- Loyalty and repeat purchase rates online are not strong due to the less-than-optimal customer experience and inherent friction of a new paradigm

- The spike of incoming Covid customers is making it even harder for grocers to deliver a good customer experience further hurting the perception of online grocery service, which will likely affect how many users stick to online orders after social distancing eases

- The average order size on Amazon is much lower than online orders of traditional grocers, where customers place orders as large as they normally do but to have delivery/pickup

- Online grocery shoppers are more likely to be in young, affluent, and urban households

Sources

Online Grocery Delivery & Pickup Scorecard: March 2020 (Brick Meets Click)

Report: Online grocery sales grew 15% this year (Grocery Dive)

PLMA Live Monthly Interview with David Bishop of Brick Meets Click

Five Charts: The State of Online Groceries (eMarketer)

Grocery Ecommerce 2019 (eMarketer)

USA: online grocery’s $60bn opportunity (IGD)

Consumer Trends in the Food and Beverage Industry (Morning Consult)

2018 U.S. Online Grocery Shopper Study (The Retail Feedback Group)

Online Grocery Shopping Report 2020 (Business Insider)

Uber and Lyft are pushing the online grocery business underground (MarketWatch citing Moody’s)

U.S. Consumers Take an Omnichannel Approach When It Comes to Grocery Shopping (NPD)

Omnichannel Grocery Is Open for Business and Ready to Grow (Bain/Google)

US Online Grocery Survey 2019 (Coresight)

Why People Still Don’t Buy Groceries Online (The Atlantic)

US online grocery adoption is lagging (Business Insider)

U.S. Census Bureau News – Quarterly Retail E-commerce Sales 4th Quarter 2019

Online grocery delivery hits a snag (Axios)

Supermarkets & Grocery Stores in the US industry trends 2014-2019 (IBIS World)

Personalization in Digital Food Retail, Shoppers Expect More (Precima)

Amazon’s online grocery lead is shrinking (Business Insider citing RBC)

Online Grocery Buyers Skew Younger, More Affluent (eMarketer citing IRI)

Winter Fancy Food Show 2020: Mintel Unlocks Key Drivers in Specialty Food (Mintel/Nosh)